Fördelar och nackdelar med privat tandvård

Vid tandläkarbesök kan man välja mellan att gå till en offentlig eller privat tandläkare. Vissa undrar om privat tandvård är bättre än offentlig. Här går vi igenom fördelar och nackdelar med privat vård.

Fördelar med privat tandvård

En stor fördel med privat vård är korta väntetider. Många privata tandläkare har mindre väntetider till tandläkartid. Det gör att patienter får vård snabbare, vilket är särskilt värdefullt vid akut behov av vård.

En annan bra sak med privata tandvård är det bredare utbudet av tjänster. Privata kliniker har ofta anpassade behandlingstider som kan passa ditt schema. Det är optimalt för patienter som arbetar mycket.

Privata

kan ofta använda nyare behandlingsmetoder. De flesta privata tandläkarmottagningar investerar i nya maskiner och instrument, vilket kan förbättra vårdupplevelsen.

Negativa aspekter av privat tandvård

Ett problem med privat tandvård är kostnaden. Privat tandvård kostar generellt mer än de statliga alternativen. Om man saknar försäkring blir kostnaden betydande att finansiera regelbundna tandläkarbesök.

En annan punkt är tillgången till viss vård. Vissa specialiserade behandlingar erbjuds inte på alla privata kliniker, och man kan bli tvungen att söka vård hos offentliga specialister.

Avslutande tankar

Sammanfattningsvis är valet mellan privat och offentlig tandvård en fråga om behov och budget. Privat tandvård erbjuder snabbare tider och oftast mer avancerad teknik, vilket ofta innebär högre priser.

Vissa föredrar den trygghet och prisvärdhet som offentlig vård erbjuder, framförallt för regelbundna, icke-akuta besök. Till sist är valet beroende av vad man prioriterar.

Related Post

The Importance of Recreational ExercisesThe Importance of Recreational Exercises

Notwithstanding the way that a large number individuals don’t think about it,recreational activities are basic for adequate physical and mental wellbeing of individuals. This might sound restricting,yet if you feel your body needs energy,you need to get really powerful. Genuine work insistently influences the body. In any case,why is everybody examining the meaning of recreational activities?

Permit us to address this request by two or three valuable results of recreational activities,which apply to people,things being what they are,real limits and the two genders. Whether or not you are not rehearsing regularly and are not a games fan,you can train yourself and get some answers concerning the explanation and meaning of standard rehearsing and the sum you can obtain by being really powerful.

Proactive undertakings are ideal for diminishing pressing factor. Sports achievements help our certainty and invigorate our resistant system. Redirection instead of our general conviction lessens the chances for likely injuries. It furthermore decreases peril of osteoporosis,further fosters our frontal cortex limits,impedes the developing cooperation and strengthens the appearance of euphoria synthetics. Additionally,who might not want to be content?

Pick an activity that suits you best: Sport is an uncommon strategy to meet new people,strengthen your social securities or basically put away exertion for yourself. It is fundamental that you pick a development that you genuinely like and little by little augmentation the power of your activity. The beginning is reliably the hardest; this applies to each and every new development,yet following fourteen days of conventional moderate exercise,not actually on ordinary timetable,your body will start to feel the useful results of the performed dynamic work and any probably fledgling’s security from game will in a little while be history.

Strangely,you don’t give up! Whatever you do,don’t confuse tip top sports with recreational activities. The later are for the most part inferred for loosening up and fun. So find an activity,which you like and can perform reliably. You might lean toward one single game or change practices according to prepare,environment or time frame. Possibly you ought to assess different activities before you track down the right one,which is thoroughly fine. Anyway long you are having a good time and are being dynamic,your physical and mental wellbeing will improve and succeed. Recall that strong and merry people look out for live more.

As you can see there are an entirely sizable measure of clarifications behind you to start working out. If you are,in any case,limited by torture in your joints,focus on your body,change your activities and choose works,which are sensible for your condition. Various people will overall cut off their games activities and rest when they start experiencing torture. This,regardless,isn’t by and large principal.

The best technique to Lead Recreational Activities

Youth and grown-up pioneers the equivalent can lead recreational activities in club settings,project social occasions,or other get-together activities. recreational activities help according to various perspectives,incorporating helping individuals with getting know each other,getting youth thinking innovatively,helping youth with concentrating and get the wriggles out,and working with propels. If you need to dominate new capacities or upgrade your opinion on driving activities,this page is for you.

Pick the Right Recreational Activity

The underlying advance to achievement in driving an activity is to pick one that is a strong counterpart for your social occasion and needs. Several intriguing focuses:

Fit

Consider the social affair you’re expecting.

What are they enthused about?

What are their grade levels? Experience levels with the subject? Limit levels?

Fun

Practices should be charming. Ceaselessly. Regardless,they should moreover to go past the DO. Activities should include:

Time to REFLECT about the activity

Taking into account how the crucial capacities learned may APPLY to various settings

Safe

Is the activity safe? What may be generally anticipated to make it alright for your social occasion?

Real

Intellectual

For All

Is the activity fair and extensive for all?

How is it possible that more would set up youth be related with helping with keeping more energetic youth secured?

What development choices or varieties might assist you with guaranteeing youthful are consolidated?

Take a gander at the Choose the Right Activity present for extra nuances.

The best strategy to Lead an Activity

When driving an activity,it’s huge for all individuals to understand the headings. By going two or three fundamental advances,pioneers can guarantee everyone likes the game:

Describe the activity: Provide a short,clear depiction of the rules,the unbiased,the cutoff points,and any prosperity controls the individuals need to ponder.

Demonstrate the activity: Some individuals learn by seeing or doing a development,so showing them what it looks like to do the activity helps them fathom.

Ask questions (you ask them; they ask you): If you need to check if they grasped the headings,you can get some information about how the development capacities. Then,ask in case they have requests.Do the Activity: Now it’s an optimal chance to do the activity. Make some extraordinary memories! As the pioneer,watch what’s happening so you can change a norm if important. Try to stop before the individuals get depleted,so they should play again in a little while.

Ask reflection questions or Adapt (optional): If the individuals need to keep on playing,you can change the game to make it sincerely testing or to guarantee everyone will take an interest also. If it’s an optimal chance to stop,get some information about the individuals’ experience,what they understood,and how they can use what they understood in various settings.

Tips for Leading Activities

Lead with enthusiasm – If you’re not stimulated or making some incredible memories,it’s unrealistic that the individuals will in light of everything.

Plan for the setting you’ll be in – Think about things like space,the amount of people,how long you’ll have,etc

Talk uproariously and clearly so everyone can hear – If you have individuals with hearing difficulties,think about how to guarantee you will be heard.Practice early – Even if you know the game or development well,it can help with practicing how you will explain it so others grasp.Mistakes happen – Remind individuals that recreational activities are for diversion,and that every so often people submit blunders. Ignore little stumbles and right more prominent mistakes tolerant. Then,forge ahead.

Examine This Report on 22 Team-building Activities Your Coworkers Won`t Hate – The …Examine This Report on 22 Team-building Activities Your Coworkers Won`t Hate – The …

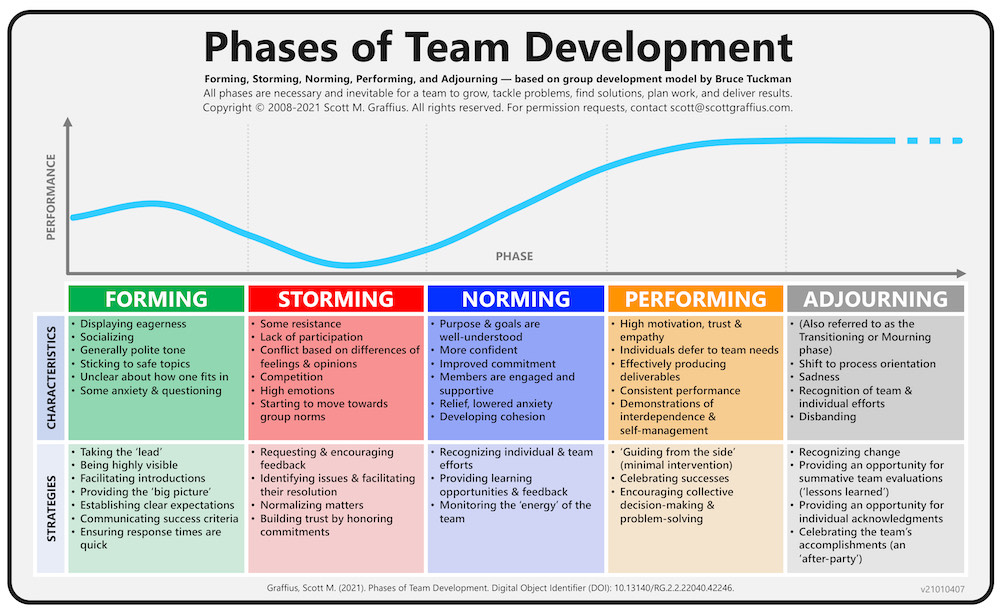

Examine This Report about What Is Team Development And Its 5 Stages [Explained]

: The mechanics of intergroup communication,decision-making,and also liability are agreed upon and managed efficiently. Nearly all teams lack one or even more of these criteria at some point in their period. Team development strives to meet these requirements with continuous reflection and also development. Like any form of development,it takes some time and also devotion to be efficient.

As the real work begins,the job might present both technological and interpersonal challenges. Private work routines,leadership choices,or gaps in communication can trigger stress within a group. Nuisance,frustration,as well as anxiety typically develop in action. This phase of team development is called storming. Storming is one of the most difficult as well as ineffective of the five stages of growth,yet it is nevertheless crucial to the team development procedure.

With this info,the group can begin desiring a far better group dynamic. The norming phase of team development is the calm after the tornado. In this stage of team development,employee fall under a rhythm as a natural taskforce. The abilities of each member are validated and made use of to execute the essential tasks.

The Ultimate Guide To 4 Stages Of Building High-performing Team – Voler Systems?

The team can manage dispute and continue with the project efficiently. Some teams reach a stage of growth in which they grow at their specific as well as cumulative tasks. The skills of each member are completely maximized,supervision is virtually never required,as well as participants really feel a strong feeling of trust fund in one an additional.

Reaching the carrying out phase is a major success and also typically speeds up some type of group learning. Group learning is a behavioral procedure of seeking,celebration,discussing,and implementing approaches of team success. Whether with training,team campaign,or cutting-edge management,team learning is an action step that ensures healthy team development.

Knowing Outcomes Define the 5 stages of team development. Explain just how team norms and cohesiveness impact efficiency. Introduction Our conversation so far has actually focused primarily on a group as an entity,not on the people inside the team. This resembles describing an automobile by its design and also shade without considering what is under the hood.

About Team Development – Ysc Consulting

In teams,the inner characteristics are individuals in the group and also just how they connect with each various other. For teams to be efficient,individuals in the group need to have the ability to interact to contribute collectively to group outcomes. But this does not occur immediately: it creates as the group interacts.

Stages of Team Development This process of finding out to function together properly is recognized as team development. Research study has actually shown that teams go via clear-cut phases during development. Bruce Tuckman,an instructional psychologist,recognized a five-stage development procedure that a lot of groups follow to become high performing. He called the phases: developing,storming,norming,performing,and also adjourning. artificial intelligence.

The majority of high-performing teams go through 5 phases of team development. Developing stage The creating stage entails a duration of orientation and also getting accustomed. Unpredictability is high throughout this phase,and also people are looking for leadership and authority. artificial intelligence. A participant that insists authority or is educated might be aimed to take control.

More About 22 Team-building Activities Your Coworkers Won`t Hate – The …

Team efficiency raises during this phase as members find out to work together and start to focus on group objectives. However,the consistency is precarious,and also if disputes re-emerge the group can relapse right into storming. In the carrying out stage,agreement as well as cooperation have been well-established and the group is mature,arranged,and well-functioning.

-

Troubles and also conflicts still emerge,yet they are managed constructively. (We will certainly go over the function of dispute and also dispute resolution in the following section). The team is concentrated on issue solving and also satisfying team goals. In the adjourning stage,the majority of the group`s objectives have actually been achieved. The focus is on finishing up last jobs and documenting the initiative and results.

There might be regret as the team finishes,so a ceremonial acknowledgement of the job as well as success of the team can be handy. If the team is a standing committee with continuous responsibility,participants may be changed by brand-new individuals as well as the group can go back to a forming or storming stage and repeat the growth process.

Little Known Questions About The 5 Stages Of Group Development Explained – Clockify Blog.?

Team norms set a criterion for habits,perspective,as well as performance that all employee are anticipated to follow. Standards resemble rules however they are not written down. Instead,all the group members unconditionally comprehend them. Standards work since staff member intend to sustain the team and also protect relationships in the group,and when standards are breached,there is peer stress or assents to implement conformity.

3 Easy Facts About Tuckman`s Stages Of Group Development – West Chester … Explained

3 Easy Facts About Tuckman`s Stages Of Group Development – West Chester … ExplainedOriginally,during the forming as well as storming stages,standards concentrate on assumptions for participation and also commitment. Later on,throughout the norming and also performing stages,norms concentrate on partnerships and degrees of performance. Efficiency standards are really vital because they define the level of job initiative as well as criteria that figure out the success of the group.

Standards are just reliable in managing habits when they are approved by staff member. The degree of on the group mostly identifies whether employee approve as well as adapt norms. Group cohesiveness is the extent that participants are brought in to the team and also are inspired to remain in the group. platform.

About Stages Of Team Development – Hawaii Doe

They attempt to adapt to norms due to the fact that they wish to maintain their connections in the group as well as they want to meet team expectations. Groups with strong performance norms and also high cohesiveness are high carrying out. As an example,the seven-member executive group at Whole Foods hangs around with each other outside of job. Its members often mingle and also also take team getaways.

You do not have to obtain superpowers from a product or create among one of the most renowned brands of your generation to be an excellent leader. Overview your team via each phase of the procedure with the complying with ideas:1. Set a clear purpose and objective as well as revisit it throughout the procedure.

It is the framework that will certainly assist you make choices. It provides you direction. Without it,you`ll go no place. People obtain so shed in a specific task that they forget why they are doing it in the first place. It is very easy to shed view of the “large photo”. Teams need a clear function and objective and also should be advised of them usually.

The Only Guide to The 5 Stages Of Team Development – Thoughtful Leader

Set guideline as well as make certain they are complied with. Rules may not appear enjoyable,but they improve complication. Without them,no one will recognize what is thought about acceptable behavior. Everybody will certainly have their very own “style” of doing points. Teams without policies are disjointed,vulnerable to conflict and also inefficient. Among the initial jobs that teams need to do is establish ground rules.

Some instances are:- Don`t interrupt an additional participant when they are speaking. Turn off your phone throughout working meetings. Track your time transparently with Toggl Track. Produce a regular work strategy with jobs as well as share it with the group. Bear in mind that guidelines are created to aid your group remain concentrated on what issues mostperformance.

-

Let other participants function as leaders or facilitators. Every group needs to have a facilitatora individual that leads as well as overviews meetings as well as conversations. Somebody who drives the team in the direction of an usual goal. As a company owner or supervisor,you might be the marked team leader. However,that doesn`t imply you must always be the one leading.

How Can I Increase My Customers Online?How Can I Increase My Customers Online?

“How can I increase my customer base online?” is one of the most important questions you may be asking. A value proposition is the best way to increase your customers online. Your value proposition is what makes your customers choose your product over other products. Without a clear value proposition sales can stagnate,or even cease altogether. You’ve probably seen it before. A good value proposition can increase your sales. To get started,look at your marketing materials. You should make them as engaging as possible.

Using a Q&A platform such as Quora is an effective way to understand the problems that customers are facing. By finding out what these issues are,you can align your solution to address them. This will help increase customer loyalty,and turn visitors into buyers. Being transparent with pricing will make your customers feel at ease when purchasing your product. Check out these CRO professionals If you can meet these expectations,you’ll see increased sales and a happier customer base.

How can you improve the quality of your online services?

You can increase your customer base online by improving the customer experience. This is an important aspect of website design that many businesses overlook. It can make a huge difference in getting customers. Superior service is another good idea. A poor customer experience is the norm. But,when you offer exceptional services,your customers are more likely not to hesitate to recommend you and to buy from you again.

It’s possible to create a great customer experience,but it is not always easy. Good customer retention strategies can help increase your profits by 25- 95%. It is also an essential step to retaining your current customers. Customer feedback can be used to improve your products or services. If you make customers feel valued,it can increase sales. Don’t forget to follow up with your leads,to reply to their comments,and to respond directly to their followers.

How can end to end customer experience be improved?

First,determine how much your customers are willing and able to spend on your products or services. To increase your sales,it is important to acquire new customers. You shouldn’t forget about your existing customers. Don’t offer your customers a better deal if they don’t want it. This will help you retain customers and increase profits. The bottom line is essential for any business. If your customers are happy,you should continue to provide them with good customer service.

Another way to increase your customers is to educate them. If you sell products or services online,educate your customers so they will buy from you. Most likely,your customers searched for something related and clicked on your site because it was on the first page. Furthermore,you should keep your website’s performance in mind. If your customers take too long to load,they’re going to leave.

What are the essential elements of a customer loyalty strategy that works?

A successful business relies on increasing sales. Aside from the revenue,it’s also the best way to create loyalty and a loyal customer base. Have a look at Nimbus Marketing in L.A Your business will be more valuable if you can sell more to existing customers. Maximizing your first sale is crucial. This means improving your sales funnel to increase your sales to existing customers. If you can get more of these first-time buyers,you’ll be on your way to a successful and profitable future.

Trust signals are important as well. While it’s not a guarantee that your customers will buy from you,putting up trust signals will help your customers feel more comfortable. Also,tell your potential customers that your business is trustworthy,reliable,and has satisfied customers. These methods will create an urgency in your potential customers. Customers will be more likely to purchase from you if the product is satisfactory.

How do I quickly increase my online sales?

An eCommerce business’ ability to increase online sales is one of its most important assets. Your business may have stopped growing in sales. Here are four tips for increasing your online sales. Your product and service should be compelling and have a strong value proposition. Also,if you have an outdated product or service,you should make changes and create a new one.

Offer free shipping. But make sure you have reasonable prices. Free shipping is a good option for products and services. This will give your customers a clear idea of the cost before they proceed to checkout. You can also offer discounts to customers who order your products online. Flat-rate shipping is also an option if you have a costly product. Flat rates will allow your customers to avoid unexpected shipping fees at check-out. Combine the best-selling methods with the most recent research to increase your online sales.

Is offering free shipping a good idea?

Offer free shipping to your customers. This is the easiest way to increase your online sales. Although it is the most expensive,it can also be one of the most cost-effective. According to a recent survey,75% expect free shipping on orders above $50. More than half your shoppers will abandon carts without it. You can keep your customers coming back to your site if you offer free shipping.

You can test different aspects of your product. Depending on the products or services you sell,split-testing is a great way to test your product and get the best results. To find the best idea,try different options on a few pages. For more http://nimbusmarketinggroup.com/conversion-rate-optimization-services You will ultimately find a solution that works for your business. This will enable you to generate more online sales,without having to compromise the quality of your product.

How can online communities and forums help your company?

A community forum can be a powerful tool to increase online sales. You can learn from others working in the same field and get to know your customers. By ensuring that your customers are happy,you can ensure that your customers will return again. You can also offer special deals and discounts to your customers. This will make you and your business more appealing to customers and increase your profit. It’s important to provide your customers with a positive experience and a good product or service.

Use trust signals. To build trust,you can include trustworthy information and professional certification to your website. The more authentic you are,the more likely you are to succeed with your online sales. For example,a good reputation will help you sell more products and services,so a customer who trusts your company is more likely to buy from you. You can quickly increase your online sales by leveraging these strategies.